Financial ratios

The investment on financial market is a profound subject, which requires a lot of knowledge. For a more precise evaluation, we must utilize various methods and instruments. It is obvious that we can not simply make investment decisions following our instinct or hunch. As a matter of fact, there are several tools we may apply in order to produce a sophisticated assessment for a company’s performance. And thereby make relevant decision on that business’ stock. The most convenient tool available for us are the financial ratios. So I would like to introduce 4 most widely used ratios to analyse the prosperity of interested firm.

To provide a reasonable evaluation, we must approach from three different directions. First of all, we would like to measure the business’ ability to pay off its short term debts, which is the liquidity. Generally, we calculate the current ratio quick ratio for the company. The equation for the ratio is stated as following:

As we can realize, it determines how many times that company’s short term obligations may be covered by its most liquidize assets. If this ratio is less than one, then the business is experiencing problems of repaying its short-term debt. Hence the business could wind up by insolvent trading. For the purpose of more vivid depiction, we will illustrate the China South Train Corporation Limited 2014 financial report to back our introduction. The working capital ratio in 2014 was 1.2265, which is a acceptable amount for investors.

In addition, we must understand the term leverage, or gearing in financial analysis. It is refer to the company’s ability to support its expansion using debts. The debt is definitely a cheaper source of finance compare to equity. However, the debt carries out certain risk of insolvency, and investors must be aware of this risk. Consequently, the Debt to Equity Ratio is implemented by financial decision makers as to interpret the company’s capital structure.

It indicates whether the firm is relying on debts or equities to support its growth. Still using our previous example, the CSR Co. Ltd. had a 172% of DE ratio. It figures out the corporation is having more debts than total share value. We need to comprehend that it is not necessarily a negative indicator, since having considerable debt is good for the growth and its cost less than equity capitals.

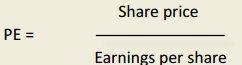

Furthermore, we should focus on the profitability of the business and return on its stock. Because the only thing investors care about is the return on their investments. The two major assessment instruments define the return on stock are: Earnings Per Share and Price to Earnings Per Share.

The EPS determines how much return can be expected for one unit of company’s share, and PE is how much money investors are required to pay in order to get one dollar return on company stock. It is crucial for us to keep in mind that this value does not disclose much information itself. What we need to do is to compare this amount to historical performance and industry average. Especially the PE ratio, it determines the anticipated period to fully recover the principal amount invested, thus the lower this number, the shorter term will take to earn the full investment value. For instance, the CSR 2014 EPS was 0.4 CNY and PE is 57.84, which means if the net profit remains the same, it will take 57.84 years for investors to earn back the total investment. By looking itself, the index may indicates the share price is over estimated. However, by comparing with the industry average and taking consideration of the company’s condition, the conclusion lands complete opposite. This high PE is derived from the monopoly position of CSR in the market, plus the future growth anticipation of the company. The demand simply pushed the share price to a high level, and therefore result with this enormous price to earnings ratio.

Although these ratios are most commonly used in financial analysis, it can only partially assist us on decision making. In my opinion, the true factors that have drastic impact on the stock markets are the flow of majority funds and the participator’s confidence on the stock.

No comments:

Post a Comment